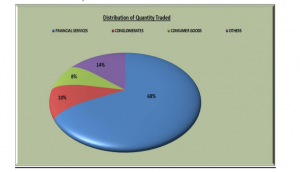

It was a historic trading week as the NSE All Share Index (ASI) posted its largest daily gain in more than five years on Thursday, 12 November 2020. The ASI rose beyond the set threshold of 5% triggering a 30 minute trading halt of all stocks for the first time since the Circuit Breaker was introduced in 2016. The Circuit Breaker protocol was triggered at 12:55p.m., when the NSE ASI increased from 33,268.36 to 34,959.39. The market reopened at exactly 1:25p.m., with a 10 minute intra-day auction session before resuming continuous trading till the close of the day at 2:30p.m. Meanwhile, a total turnover of 4.509 billion shares worth N58.733 billion in 47,140 deals were traded this week by investors on the floor of the Exchange, in contrast to a total of 2.067 billion shares valued at N22.636 billion that exchanged hands last week in 25,187 deals. The Financial Services industry (measured by volume) led the activity chart with 3.073 billion shares valued at N35.408 billion traded in 25,894 deals; thus contributing 68.15% and 60.29% to the total equity turnover volume and value respectively. The Conglomerates Industry followed with 437.822 million shares worth N771.280 million in 1,864 deals. The third place was the Consumer Goods Industry, with a turnover of 373.613 million shares worth N7.816 billion in 7,471 deals. Trading in the top three equities namely Zenith Bank Plc, FBN Holding Plc and Transcorp Hotels Plc (measured by volume) accounted for 1.426 billion shares worth N18.083 billion in 9,537 deals, contributing 31.63% and 30.79% to the total equity turnover volume and value respectively.

http://www.nse.com.ng/market_data-site/other-market-information-site/Week%20Market%20Report/Weekly%20Market%20Report%20for%20the%20Week%20Ended%2013-11-2020.pdf